dupage county sales tax on food

The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. WBBM NEWSRADIO -- DuPage County officials said the county missed out on as much as four million dollars in cannabis sales tax money and now theres finger-pointing on whos to blame.

This is the total of state and county sales tax rates.

. Higher maximum sales tax than 97 of Illinois counties. 2 Randomized Auction Management System which. County Farm Road Wheaton IL 60187.

Beginning May 2 2022 through September 30 2022 payments may also be mailed to. The aggregate rate for sales tax in the DuPage portion of the Village is 800. A retailers occupation tax on the gross receipts from food prepared for immediate consumption alcoholic beverages and soft drinks is imposed on sales within Chicagos Metropolitan Pier and.

Rates include the state and county taxes. As of February 2014. Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other counties around the United States. State Food Tax. Important Chicago Illinois Sales Tax Information.

What is the sales tax rate in Dupage County. The Chicago area imposes the highest taxes on restaurant food items of any area in Illinois. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption.

The drop in sales tax will save DuPage County consumers 36 million annually. The minimum combined 2022 sales tax rate for Dupage County Illinois is. The 2018 United States Supreme Court decision in South Dakota v.

One of the reasons for this is that they are difficult to prepare properly. State EXEMPTIONS Prescription Drugs. The total sales tax rate in any given location can be broken down into state county city and special district rates.

630 407 5858 Phone 630 407 5860 Fax The Dupage County Tax Assessors Office is located in Wheaton Illinois. State Food Tax. 1 to reduce the 65 state sales tax on food not to 0 but to 4.

Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state. The Illinois sales tax of 625 applies countywide. The Dupage County sales tax rate is.

Sales tax returns are by definition cash basis returns rather than. In addition to the sales tax reduction the commission lowered its water. The Dupage County sales tax rate is.

Food Drug Tax 175. Food Drug Tax 175. Beginning May 2 2022 through September 30 2022 payments may also be mailed to.

10 hours agoThe law HB 2106 took effect July 1 but waits until Jan. What is the sales tax rate for Hamilton County Tennessee. Puerto Rico has a 105 sales tax and Dupage County collects an additional NA so the minimum sales tax rate in Dupage County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dupage.

Food Drug Tax 175. 60186 - County sales and use tax rates - 2022 DuPage County Illinois State. By Bernie Tafoya.

The Department helps ensure budget compliance through financial reporting monitoring internal controls and cash flow management. The base sales tax rate in DuPage County is 725 725 cents per 100. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425.

The one with the highest sales tax rate is 60133 and the one with the lowest sales tax rate is 60157. Important Oak Brook Illinois Sales Tax Information. The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County Farm Road Wheaton Illinois 60187.

The 2016 sales tax rate in Hamilton County is 925. This is the total of state and county sales tax rates. Finance ensures compliance with all County bonded debt requirements and payment of such debt.

The Cook County Illinois sales tax is 900 consisting of 625 Illinois state sales tax and 275 Cook County local sales taxesThe local sales tax consists of a 175 county sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. The Illinois state sales tax rate is currently. State EXEMPTIONS Prescription Drugs.

Box 4203 Carol Stream IL 60197-4203. Six months from now instead of paying the second-highest state tax. The most populous zip code in DuPage County Illinois is 60148.

DuPage County Board Chairman Dan Cronin DuPage Water Commission Chairman Jim Zay and members of the County Board celebrated the sales tax decline with a cake at the May 24 County Board meeting. This is the total of state and county sales tax rates. Estimated County Tax Rate.

Food Drug Tax 175. 7 hours agoCook County Minimum Wage. DuPage County Collector PO.

That includes a Tennessee sales tax rate of 7 plus a county-wide sales tax rate of 2. The minimum combined 2022 sales tax rate for Dupage County Illinois is. 60191 - County sales and use tax rates - 2022 DuPage County Illinois State.

Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. As of February 2014. The Finance Department is responsible for preparation and issuance of the Countys annual financial audit.

60191 - combined sales tax food drug exemptions - 2022 Wood dale DuPage County Illinois State. Cook County which has its own minimum wage ordinance will also increase its minimum wage on July 1 from 13 to 1335 for non-tipped workers and from 660 to 740. Tax allocation breakdown of the 7 percent sales tax rate on General.

As far as all cities towns and locations go the place with the highest sales tax rate is Hanover Park and the place with the lowest sales tax rate is Clarendon Hills. In addition to the Illinois state tax of 625 percent restaurant food purchases in Chicago are subject to Cook County tax of 125 percent and a Chicago city tax of 125 percent. Estimated County Tax Rate.

Cook County and its surrounding counties also impose a Regional. This measurement as required by law was built upon. 60186 - combined sales tax food drug exemptions - 2022 West chicago DuPage County Illinois State.

DuPage County officials estimate the county lost between 25-4 million because the state didnt start taking. The base sales tax rate in DuPage County is 7 7 cents per 100. The Cook County Sales Tax is collected by the merchant on all qualifying sales made within Cook.

Download the registration form for 20201 Tax Sale PDF In Response to the pandemic the DuPage County Treasurer will be using a new system names RAMS. May 11 2022 1224 pm.

Dupage County Taxes Tax Rate Information Dupageblog Com

1st Annual State Of Dupage Western Suburbs Cre Market

Toyota Toyota Racing Kyle Busch Puts On A Winning Show At Bristol Racing Toyota Camry

Defining Collections Resolutions With The Cdtfa Brotman Law

Business Climate Archives Choose Dupage

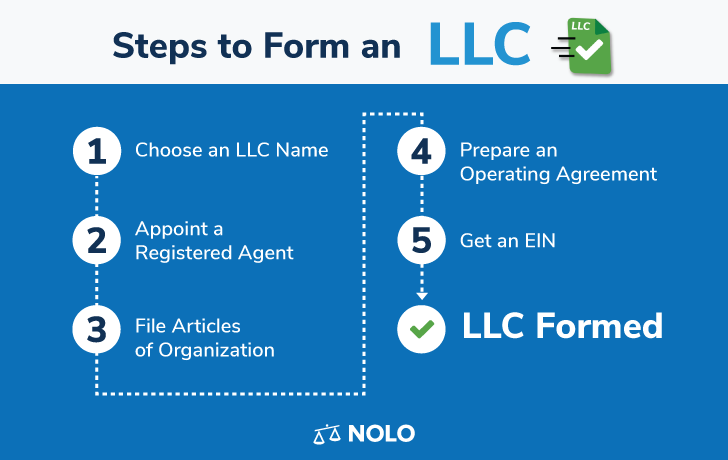

How To Start An Llc In Illinois Llc In Il Nolo Nolo

Dupage County Taxes Tax Rate Information Dupageblog Com

Celeste Paris Customer Service Supervisor Mizkan America Linkedin

O Hare S Brighton Store Is Offering A Free Necklace With A Single Same Day Purchase Of 100 Or More Near Gate H3 Li Airport Shopping Free Necklace Brighton

Great Wolf Lodge To Take Over Redevelop Key Lime Cove In Gurnee Key Lime Cove Great Wolf Lodge Lake County

Scores Business Plan Template Elegant Score Business Plan Template Score B Business Plan Template Small Business Plan Template Startup Business Plan Template

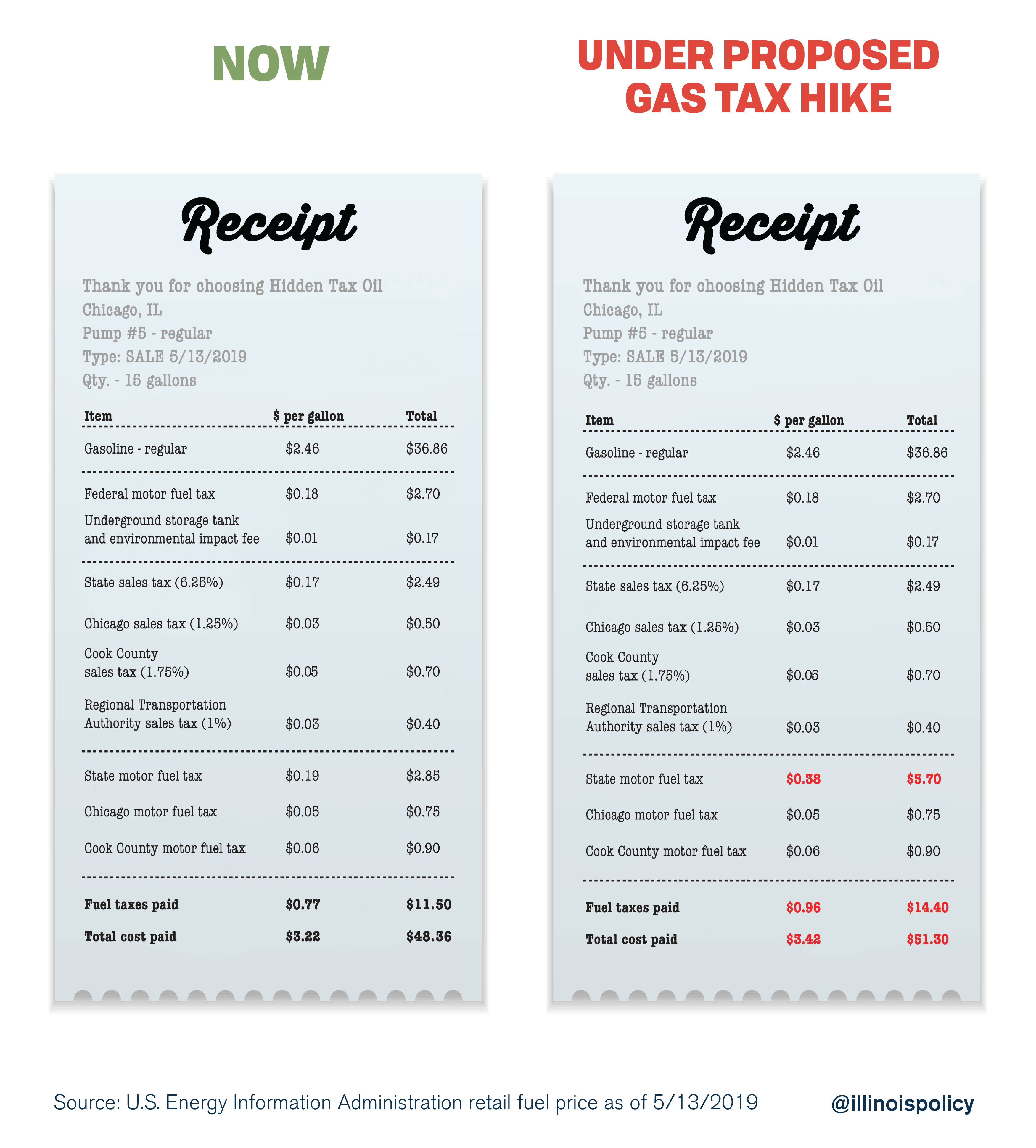

Pritzker Gas Tax Hike Would Cost Average Driver 100 More Per Year

Custom Waterfall And Slide Quantus Pools Quantuspools Com 847 907 4995 Pool Water Features Pool Waterfall Custom Swimming Pool